Managing everyday money is a difficult task. When we do not effectively manage our spending and income, we lose track of where we have spent our money and how much we have left. However, with these good apps, financial management has become lot more convenient. These money management apps for Android allow you to manage all of your costs and revenue in a simple user interface. You may safeguard your data by backing up all of your reports to the cloud or local storage. Some apps even allow you to take images of invoices and receipts, connect numerous accounts and currencies, and use an income tax calculator, making it an asset management software.

1. Expense Manager by Bishinews

This program organizes costs and revenue into week, month, and year categories. You may examine your budget by category, schedule payments, set up notifications, photograph receipts, and save data to an SD card or the cloud. The software allows you to create numerous accounts, search and configure the categories, and access handy features such as a currency converter, tax calculator, and charts, among other things.

2. Expense Manager by Markus Hintersteiner

Another money software for Android is Expense Manager, which supports holo themes. This personal financial software allows you to record spending with the option to create new categories, restrict the budget, dash-clock integration, browse by categories such as week, month, and year, and some additional features available through in-app purchases such as record incomes, comprehensive data, and expense distribution.

3. Financius Expense Manager

This program assists you in keeping track of all your spending. The software has online backup, dash-clock connection, and the option to add numerous accounts in different currencies. You may also reorganize categories, adjust the reporting periods, add costs and income, and move funds across accounts.

4. Control Expenses

This money tool lets you track your costs and revenue using lists. The program has the ability to export reports to the cloud, utilize excel sheets, take pictures of receipts, use income and spending in other currencies with an exchange rate converter, compare different categories, and even add virtual accounts, virtual wallets, and virtual loan management.

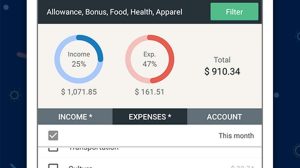

5. Money Manager Expense and Budget

This budget and asset management software includes budget management, credit and debit card management, and automated asset transfer for effective and easy spending management. It also has a password to keep your data safe, backup and restore capability, a calculator, subcategory, bookmark function, and statistics.

6. Trackash- Expense Manager

This software is often referred to as Twitter for Expenses. The software categorizes spending using hashtags, allows you to manage expenses and revenue, has a password, fast stats, and allows you to browse by category, day, month, and year.

7. Daily Expense Manager

This finance software is a personal money manager with several tools for managing your finances. You can monitor all of your costs and income, create alarms, and configure categories, as well as support for numerous currencies. The program offers automatic backup, receipt capturing, and emailing records in several formats.

8. Financisto Expense Manager

This is an open source money management app. It has exchange rates and the option to connect various accounts and currencies. You may schedule and divide transactions, create additional categories, and add custom characteristics. Backup to the cloud or automate backups, import reports, and monitor whereabouts are all options.

9. AndroMoney (Expense Track)

The program has cloud backup and sync capabilities, the ability to add additional accounts, password security for the app, and the ability to backup reports to Excel or Mac format. The program supports a variety of currencies as well as realistic pie charts and bar graphs.

10. Mobills Finance Manager

This software is a simple cost and income management tool. The software includes simple registration by kind and payment, as well as charts for spending and income analysis. You may save your data and reports to the cloud or an SD card. You may export reports to Excel and open them on any PC to obtain the monthly statement. You may extract information about spending over a certain time period and filter it by expense, payment, or period.